5:46 pm •

Categories: Build a Purpose-driven Business, funding, SRI •

by Olivia Khalili

I’m wrapping up Social Business Venture week with a look at funding options for the breed of businesses that generate profits but exist primarily to fulfill a social need. The legal structure of your business should take into account how you plan to operate and earn revenue. Neither of these decisions can be taken lightly […]

Comments Off on 4 Funding Options for Your Social Business Venture

5:56 pm •

Categories: Interviews, Podcast, SRI, Tools •

by admin

In between profiteering and starry-eyed do-gooding is a place where values can incur value. This is the place of Human Impact + Profit (HIP), a methodology created by R. Paul Herman that aims to help investors and businesses make money while solving key human needs. Companies that deliver human impact and profit can gain a magic […]

Comments Off on How Nike, Walmart and Cisco Are Being More HIP and Growing Profits With Purpose–With R. Paul Herman

2:41 pm •

Categories: Businesses, Interviews, Micro-lending, Podcast, SRI, Web/Tech •

by admin

Michael Van Patten used to give out his entire allowance when he lived in Ecuador during high school. This went against common practice to ignore people with their hands and pretend they weren’t there. The poverty he saw stuck with him for years but didn’t affect the way he made a living, until recently. Click the […]

Comments Off on How He Turned His 20 Years on Wall Street Into a Hub for Impact Investing –with Mike Van Patten

8:33 pm •

Categories: Businesses, Interviews, Podcast, SRI •

by admin

I created Cause Capitalism to answer the question of how you can have a stronger business and help change the world. The problem with such a nifty concept is that it’s still new, which means that all the ‘market mechanisms’ aren’t in place to help your early social enterprise scale to serve more people. As […]

3 Comments

1:48 pm •

Categories: Businesses, Interviews, Podcast, SRI •

by admin

Portfolio 21 Investments, a mutual fund that invests in ecologically sustainable companies, was founded by a man who received two shares of Mattel Toys as a boy and explored the world at large as a young man. Pairing his interests in finance and social good, Carsten Henningsen founded Portfolio 21 in 1982. The firm is stringent […]

Comments Off on Why More Money is Made on Environmentally Astute Companies–with Carsten Henningsen

4:04 pm •

Categories: Businesses, Interviews, Micro-lending, Podcast, SRI •

by admin

When Muhammad Yunus set about creating Grameen Bank in 1983 he asked ShoreBank for launch advice and help raising capital. By then ShoreBank had already been busy for the last 10 years revitalizing urban communities on Chicago’s South Side by funding development projects and providing small business and home loans to under-served, low to moderate income populations. Founded in 1973, ShoreBank […]

2 Comments

7:40 pm •

Categories: Corporate Social Responsibility, Employee Involvement, SRI, Trends •

by admin

Employee compensation packages are dropping in financial value–but this time, it’s not because of the recession alone. From MBAs to college graduates, potential employees are looking for more than stock options and dental care from their employers. In “Saving the World at Work” Tim Sanders calls this “Social Compensation–the purpose that comes with the paycheck.” […]

6 Comments

1:25 pm •

Categories: SRI •

by admin

Socially responsible investing, which now makes up 10 percent of overall investments in the U.S. market, has a new sub-segment, the “green” bank. Peter Liu founded the first explicitly green bank in the United States to fit a market opportunity as much as a social one. “We believe that we are evolving from what was […]

3 Comments

10:17 am •

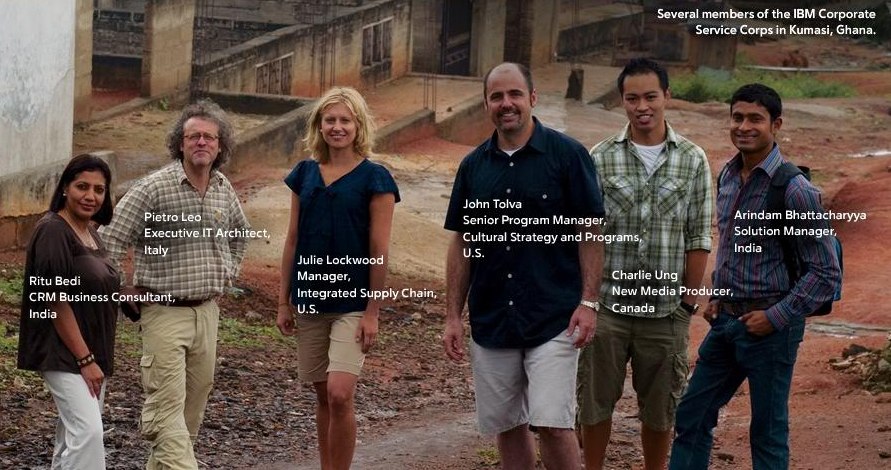

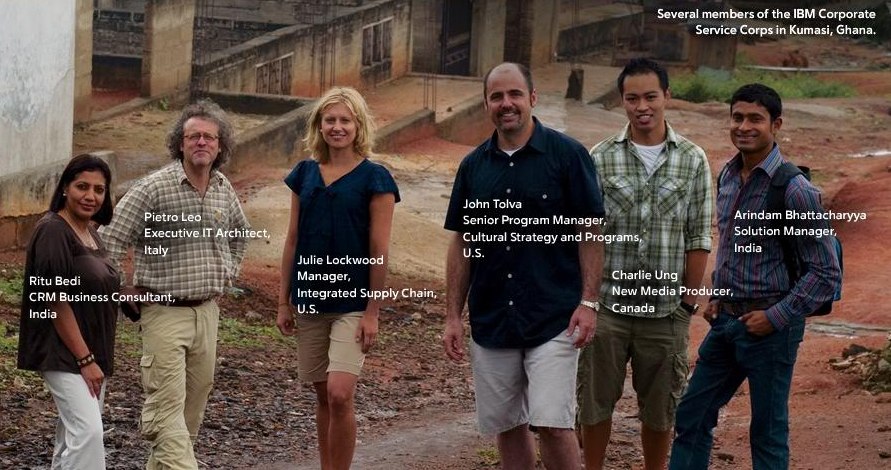

Categories: Business Models, Corporate Social Responsibility, Employee Involvement, SRI •

by admin

As is common practice with large firms, Deloitte provides pro bono services to local communities. Employees of the consulting giant also volunteer their time and skills with area nonprofits. It’s a pretty good one-two punch as big-name corporate responsibility goes. Deloitte, however, saw opportunity to leverage a greater impact. Welcome philanthropy, in the form of […]

Comments Off on Pro Bono Work Grows Wings at Deloitte

I'm Olivia Khalili. I created Cause Capitalism to show you how to grow your business by incorporating a social mission.

I'm Olivia Khalili. I created Cause Capitalism to show you how to grow your business by incorporating a social mission.